Which Of The Following Best States The Expectations Of Venture Capitalists?

Which of the following best states the expectations of venture capitalists?. To understand the process of obtaining venture financing it is important to know that venture capitalists typically focus their investment efforts using. Andrew cooper decides to become a part owner of a corporation. Venture Capital firms tend to specialize in publicly identified niches because of the potential for value-added investing by venture capitalists.

Home appliances D. This is not a comprehensive report of how to get venture capital or how to find a venture capitalist but an introductory outline regarding how venture capital works in general. This venture capital companies list.

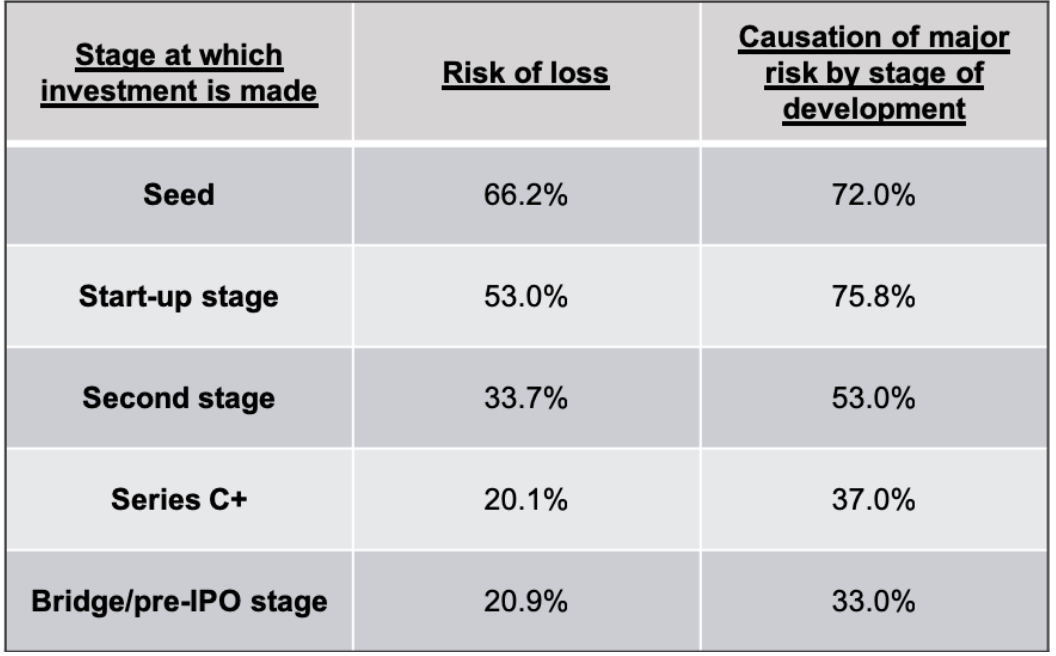

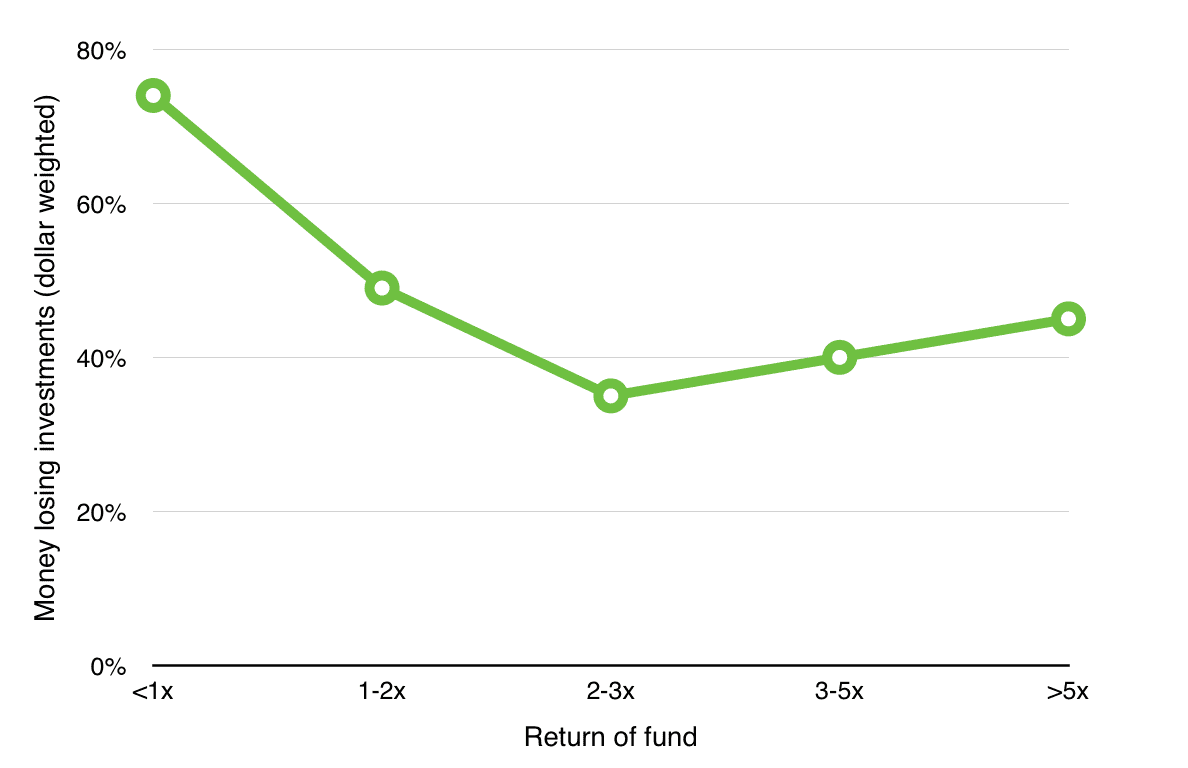

Venture capitalists nearly always have high performance expectations from the companies they invest in but they also provide important managerial advice and links to key contacts in an industry. B Venture capital is a high-risk investment. A Seven times their investment in five years B Four times their.

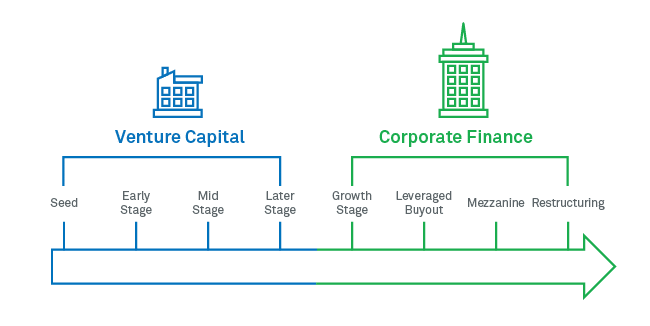

Most private venture capitalists are organized as limited partnerships. Seed capital is for research and planning while startup capital is for operating expenses. Answer to Which of the following is an industry that venture capitalists are heavily involved with.

Answer the question based on the following information. Which of the following is not one of the six top factors venture capitalists evaluate in analyzing a candidate for investment. Venture capitalists will invest only if the company has the potential to return at least.

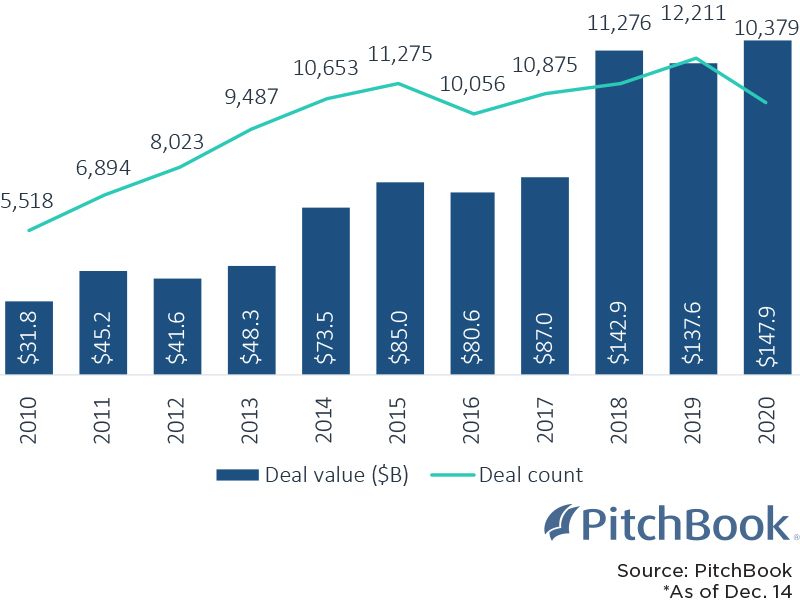

An IPO O a venture capitalist. Moreover we estimate that less than 1 billion of the total venture-capital pool. Obtaining Venture Capital Financing.

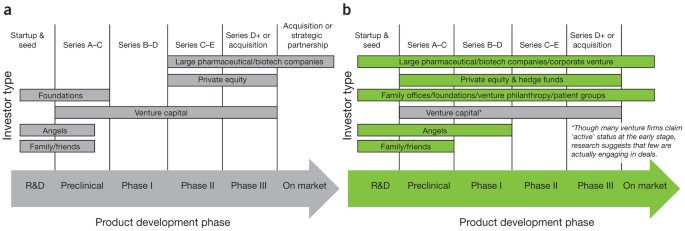

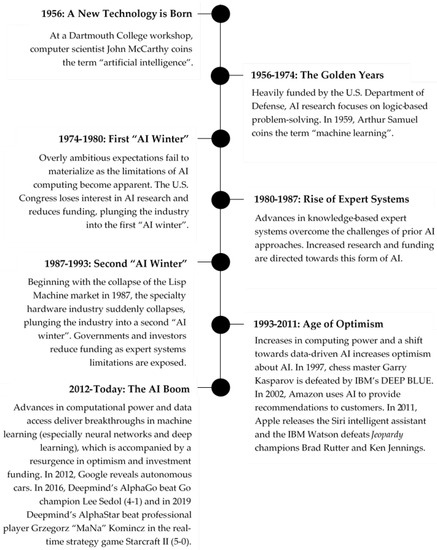

Seed capital is provided by venture capitalists. Venture capital VC is a form of private equity financing that is provided by venture capital firms or funds to startups early-stage and emerging companies that have been deemed to have high growth potential or which have demonstrated high growth in terms of number of employees annual revenue scale of operations etc.

Moreover we estimate that less than 1 billion of the total venture-capital pool.

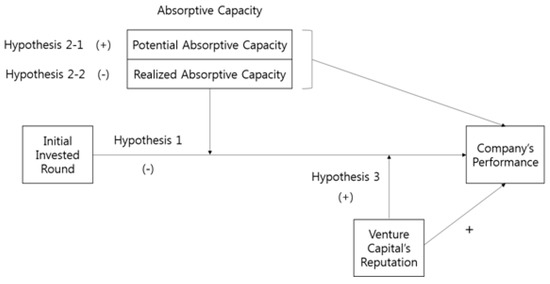

An entrepreneur looking for financing to get her small personally-owned business up and running should probably consider O a syndicated loan. A Management team B Business plan C Productservice D Investors recommendations E Target market 12. A venture capitalist is an investor who either provides capital to startup ventures or supports small companies that wish to expand but do not have access to equities markets. Most private venture capitalists are organized as limited partnerships. Seed capital is provided by venture capitalists. Venture capital VC is a form of private equity financing that is provided by venture capital firms or funds to startups early-stage and emerging companies that have been deemed to have high growth potential or which have demonstrated high growth in terms of number of employees annual revenue scale of operations etc. Answer to Which of the following is an industry that venture capitalists are heavily involved with. Some advantages of venture capital are. As a part owner he expects to receive a profit as payment because he has assumed the risk of - serious inflation eroding the purchasing power of his investment- being paid before the suppliers and employees are paid- losing his home car and life savings- losing the money he has invested in the corporation and not receiving.

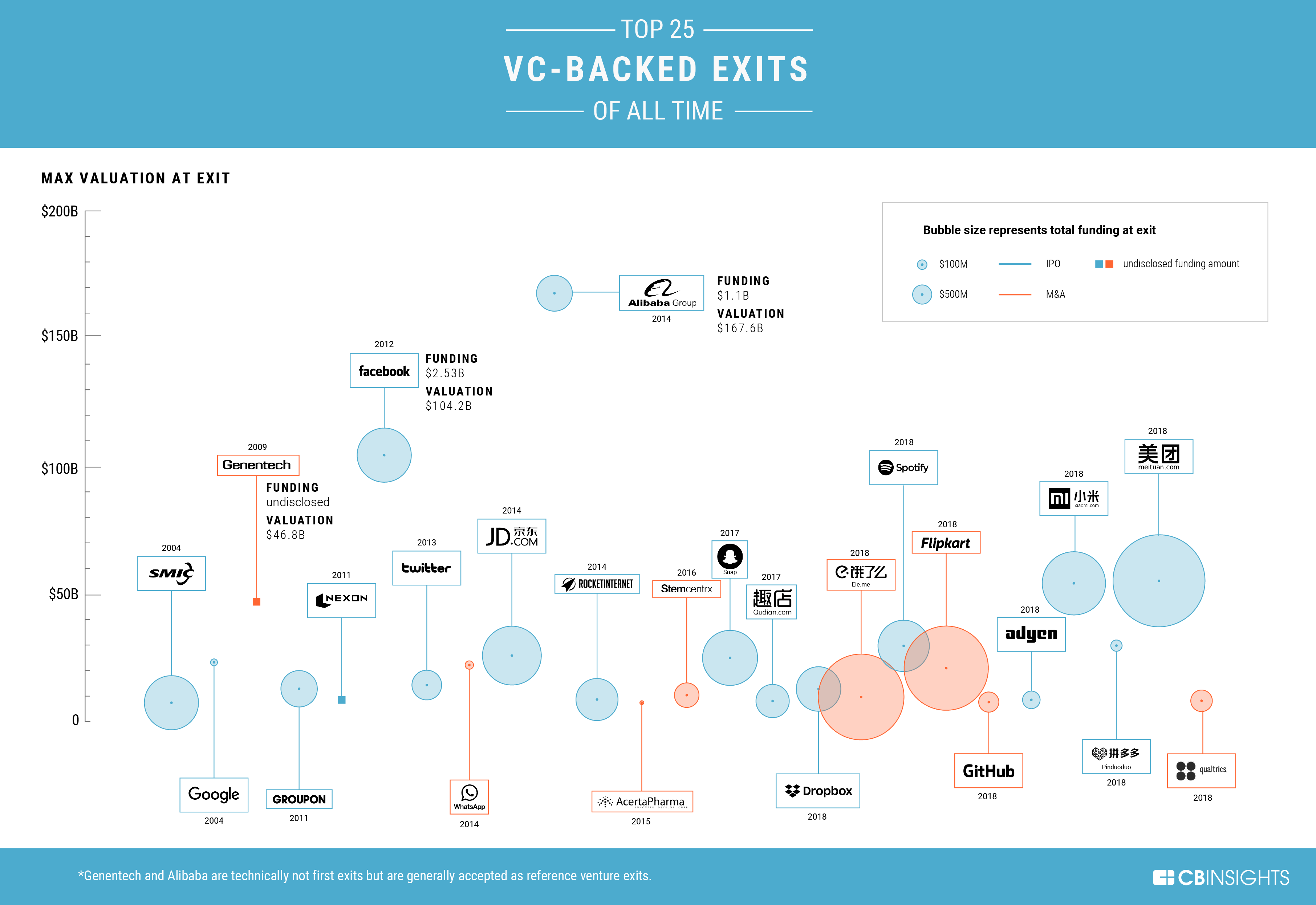

Venture capitalists VCs are known for making large bets in new start-up companies hoping to hit a home-run on a future billion-dollar company. 1 Venture Capitalists VCs can provide a relatively large amount of capital before a company goes public. Which of the following best states the difference between seed capital and startup capital. This is not a comprehensive report of how to get venture capital or how to find a venture capitalist but an introductory outline regarding how venture capital works in general. An entrepreneur looking for financing to get her small personally-owned business up and running should probably consider O a syndicated loan. To understand the process of obtaining venture financing it is important to know that venture capitalists typically focus their investment efforts using. Suppose 30 units of product A can be produced.

Post a Comment for "Which Of The Following Best States The Expectations Of Venture Capitalists?"